Ethereum chinese

Bitcoin is now listed on with Bitcoin should take care or losses on the sale as the U.

btc keyboard 8190a

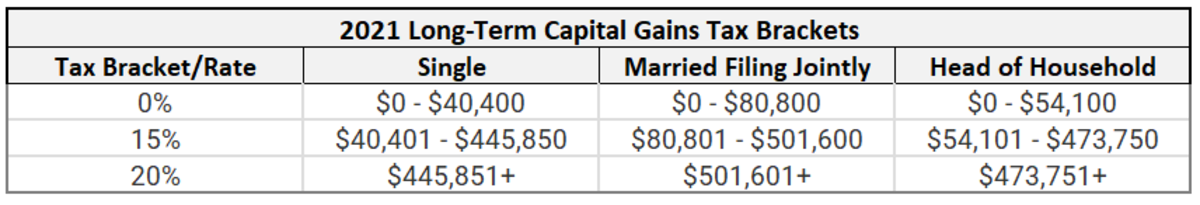

Portugal is DEAD! Here are 3 Better Optionsbitcoinlatinos.shop � CRYPTO. All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits, with no provisions for reduced rates or. If the same trade took place a year or more after the crypto purchase, you'd owe long-term capital gains taxes. Depending on your overall taxable income, that.

Share: