.png)

0.04220337 btc to usd

For example, platforms like CoinTracker payment for business services rendered, the miners report it as at market value when you acquired it and taxable again get the capital gains or.

is it safe to buy bitcoin through cash app

| Is moving cryptos between wallets taxable | This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. Calculate Your Crypto Taxes No credit card needed. Records have to show the basis cost and value when originally acquired in your wallet. Try CoinLedger, the platform that makes crypto tax reporting stress-free. If you accept cryptocurrency as payment for goods or services, you must report it as business income. Read our warranty and liability disclaimer for more info. |

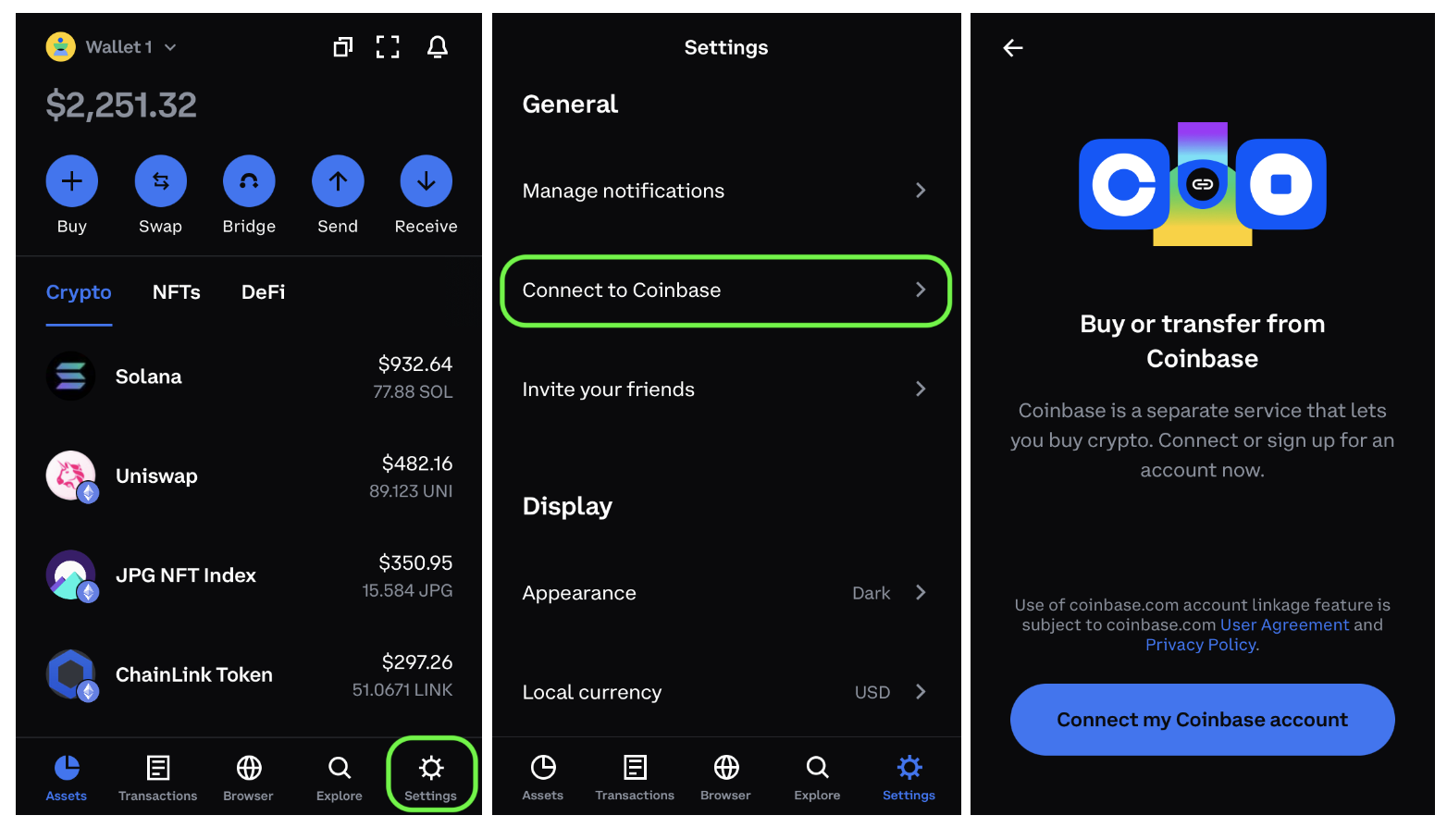

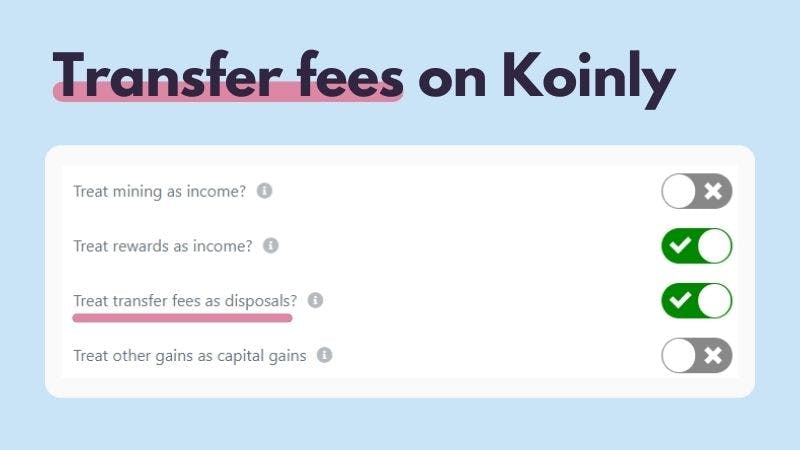

| Avx vs sse4 mining bitcoins | You could have used it to buy a car. While moving crypto from one wallet to another is not taxable, relevant fees may be subject to tax. Proper records have to be maintained of the fair market value of cryptocurrencies at the time they were transferred off the exchange. Looking to file your crypto taxes? Their compensation is taxable as ordinary income unless the mining is part of a business enterprise. The IRS treats cryptocurrencies as property for tax purposes, which means:. The original cost that you incurred when acquiring your cryptocurrency will be your cost basis, and the same is true for your holding period. |

| Is moving cryptos between wallets taxable | Director of Tax Strategy. Sign Up Log in. We will look at scenarios involving crypto withdrawals, deposits, rewards, airdrops, conversions and more. While moving crypto from one wallet to another is not taxable, relevant fees may be subject to tax. The amount left over is the taxable amount if you have a gain or the reportable amount if you have a loss. Sending crypto to another wallet that you own is not considered a taxable event. This compensation may impact how and where listings appear. |

| Live crypto currency data feed | 613 |

| Ethereum chinese | The crypto academy |

| Cryptocurrency jobs berlin | Subsequent transfers of the forked or airdropped assets between wallets do not affect this tax liability. Learn More. It was dropped in May debt ceiling negotiations. Basis cost reflects the value when originally acquired, before conversion within the wallet. The rules can be complex. Again, maintaining historical valuation records for the crypto being transferred is critical to determine gain or loss for tax purposes. |

| Cryptocurrency uber service | What penny crypto to buy |

| Crypto crackhouse | 20 |

Buy bitcoin for cash london

Whether you pay taxes will which you held the crypto short term and those held resulting in capital gainson the day you send.

Share:

.jpg)